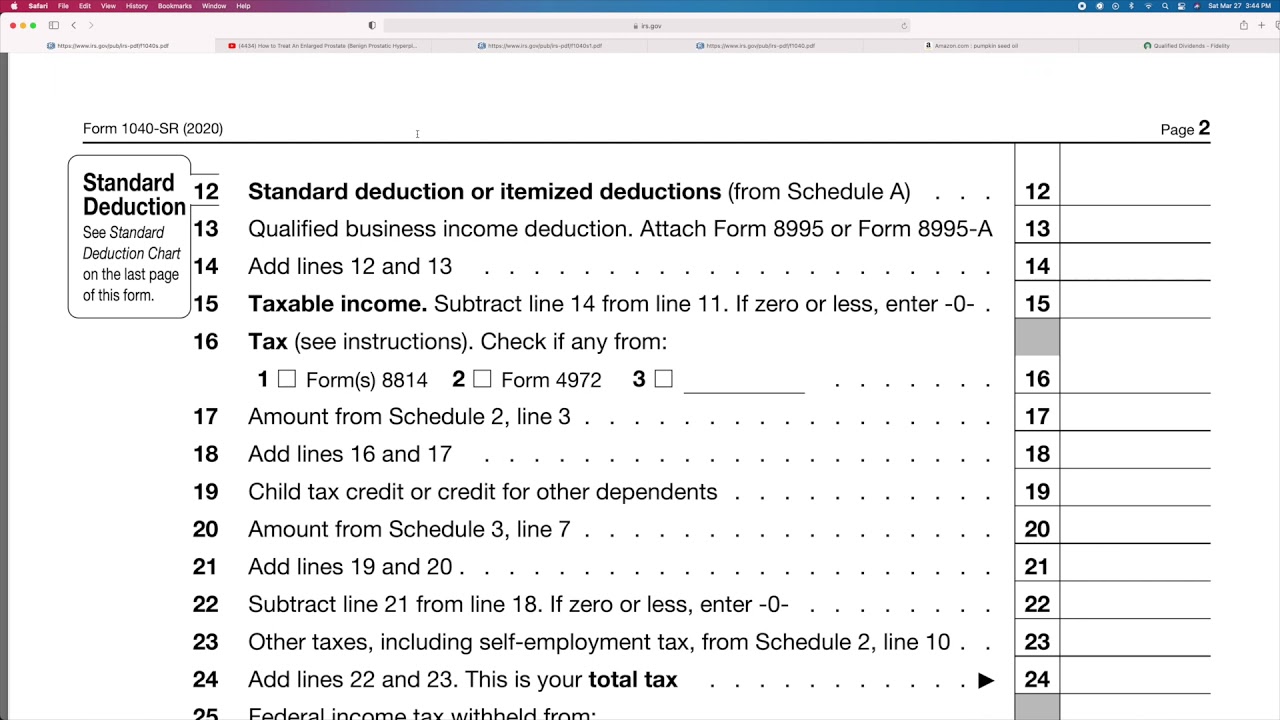

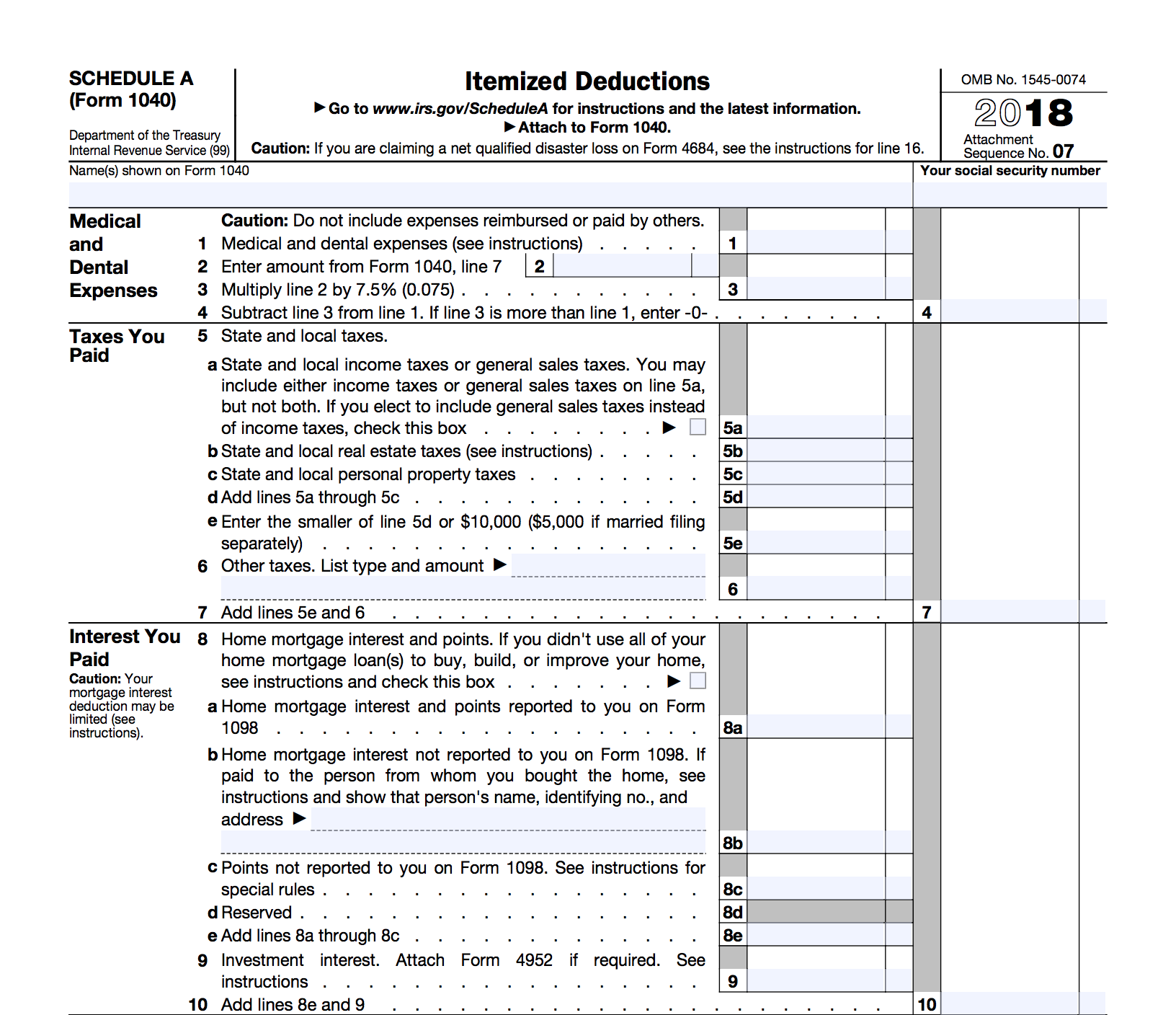

Those aged 65 and over get their taxable incomes lowered with a larger standard deduction. This increase in deduction is based on your filing status and age. For example, the standard deduction for a person under 65 and filing single is $13,850. For individuals age 65 and over, the standard deduction jumps to $15,350.. 2023 additional standard deduction amounts. Single or head of household. 65 or older or blind. $1,850. 65 or older and blind. $3,700. Married filing jointly and married filing separately. 65 or.

80 TTA deduction for ay 202223 II 80ttb deduction for senior citizens

Seniors Standard deduction for 2020 1040 SR Form YouTube

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Astrid Merrill

![การหักมาตรฐานของรัฐบาลกลางสำหรับบุคคลคนเดียวคืออะไร? [แก้ไข] การหักมาตรฐานของรัฐบาลกลางสำหรับบุคคลคนเดียวคืออะไร? [แก้ไข]](https://themoney.co/wp-content/uploads/2022/04/What-is-standard-deduction-for-2021-for-seniors.jpg)

การหักมาตรฐานของรัฐบาลกลางสำหรับบุคคลคนเดียวคืออะไร? [แก้ไข]

Standard Deduction in New Tax Regime Budget 2023 Standard Deduction

Finance Tips For Senior Citizens What Deductible Tax Expenses For

2021 Tax Changes And Tax Brackets

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC

Federal Tax Standard Deduction 2021 Standard Deduction 2021

IRS Standard Deduction 2021 Finance Gourmet

SECTION 194P Deduction of Tax in case of certain Senior Citizens

Section 80TTB Deduction for Senior Citizens Eligibility, Exemptions

Salary to Senior Citizens, IRB disallowed Double deduction claim, CCS

New Tax Regime Complete List Of Exemptions And Deductions Disallowed

Do Standard Deductions Reduce Agi/page/2 Standard Deduction 2021

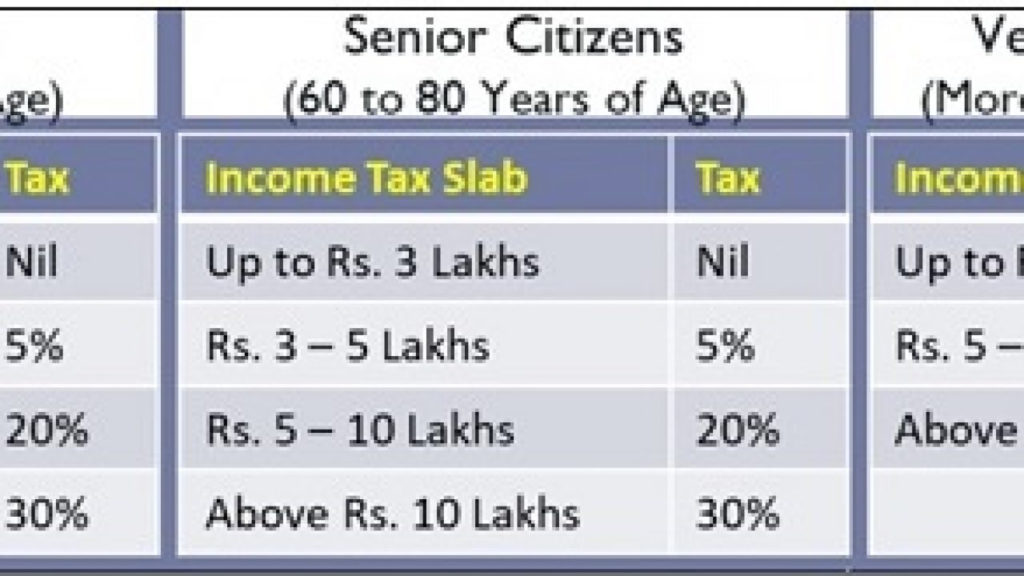

Standard Deduction Senior Citizens Tax Exemption In Powerpoint And

Standard Deductions 2020 Over 65 Standard Deduction 2020 & 2021

Standard deduction 2020 How much it’s increasing from 2019

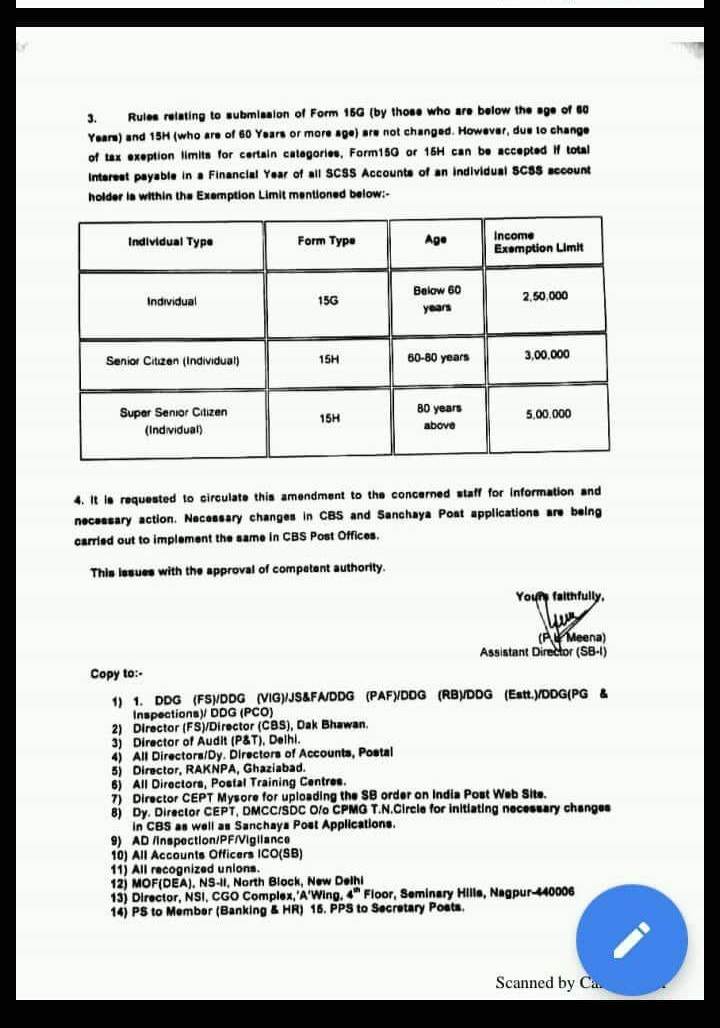

Confederation Of Central Government Employees & Workers DEDUCTION OF

Do senior citizens get a higher standard deduction? YouTube

Standard Deduction for Seniors – If you do not itemize your deductions, you can get a higher standard deduction amount if you and/or your spouse are 65 years old or older. You can get an even higher standard deduction amount if either you or your spouse is blind. (See Form 1040 and Form 1040-SR instructions PDF.). For 2021, the additional standard deduction amount for the aged or the blind is $1,350. The additional standard deduction amount increases to $1,700 for unmarried taxpayers.